Roth Conversions and Federal Tax Brackets

What is a Roth Conversion?

A Roth conversion is when a taxpayer decides to move (convert) pre-tax retirement funds (IRA, 457, 401k, etc.) to a Roth IRA. A Roth conversion must take place during a tax year and once it is complete it cannot be undone. The conversion results in taxes being owed, in most cases. There are no income limits to do a Roth conversion and there are no limits on the amount that can be converted. Also, a taxpayer does not have to convert the entire balance of the pre-tax retirement account but can choose to do partial Roth conversions.

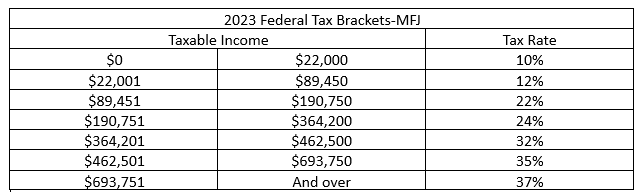

Federal Tax Brackets

Under current tax law there are seven federal income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. A taxpayer’s taxable income and filing status determine which tax brackets and rates apply. The following table displays the rates and brackets for a Married Filing Joint (MFJ) taxpayer.

Filling Up a Tax Bracket with a Roth Conversion

A strategy some FDNY and NYPD retirees might want to consider is filling up their federal tax bracket with a Roth conversion. The following is an example using the strategy.

Example #1

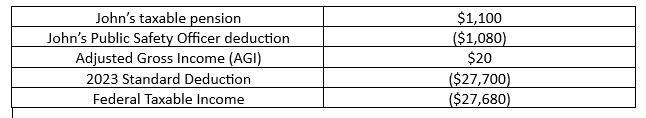

John is a recently retired FDNY member who was granted an accidental disability retirement. John is married, files his taxes as married filing jointly, and his spouse earns $50,000 per year. Shortly after retirement, John elected to rollover his entire taxable excess AND 90% of his required minimum to an IRA. By doing this, John’s taxable portion of his pension is only $1,100 per year. Calculate taxable income:

After John calculates their taxable income, he reviews the MFJ tax bracket to determine what federal tax bracket they are in and what the upper limit of the bracket is. With a taxable income of $22,320, John and his spouse are in the 12% bracket and can go all the way up to $89,450 before going into the 22% bracket. Therefore, they have $67,130 ($89,450 - $22,320) of room to do a Roth conversion and stay in the 12% bracket. John could either convert the entire $67,130 or any portion. Note: The dollar values of the federal tax brackets change every tax year.

Negative Taxable Income and a Roth Conversion-Nothing Better!

Is it possible for a taxpayer to have negative taxable income? Yes, it is possible although not very common. A younger FDNY/NYPD member who retired with an accidental disability pension and elected to take a full final withdrawal may have negative taxable income. Or a FDNY/NYPD member who retired before 01/01/2009 with an accidental disability pension may have negative taxable income.

Example #2

Example #2 is an example of a taxpayer with anticipated negative taxable income for the tax year. Using the same assumptions in Example #1 except John’s spouse does not have any earnings. Calculate taxable income:

John and his spouse anticipate negative taxable income of $27,680 for the tax year. What would happen if John did a Roth conversion in the amount of $27,680? Will any federal tax be owed? If John does a Roth conversion of $27,680, they will not owe any federal tax. In other words, John could do a Roth conversion without paying any federal tax!

Note: Click here to use a 2023 negative taxable income calculator. Click next in the upper right corner of the 2023 Federal Tax Withholding calculator to view the negative taxable income calculator.

Roth Conversions and Child Tax Credit

In some cases, it may make sense to do a Roth conversion to take advantage of federal tax credits.

Example #3

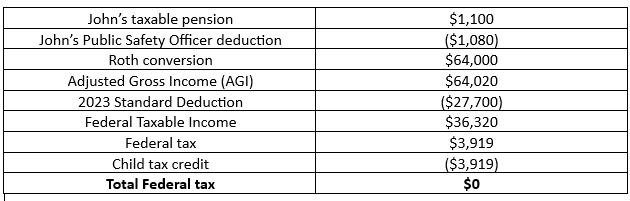

Using the same assumptions in Example #2 except John and his spouse have two children (ages 10 and 12) and decide to do a $64,000 Roth conversion. Calculate taxable income and taxes owed:

In this example, John and his spouse converted a total of $64,000 to a Roth IRA and paid zero in federal tax. The child tax credit was used to offset the amount of federal tax owed.

Conclusion

As these examples highlight, it is important for FDNY/NYPD members to perform tax planning during the tax year to determine if a Roth conversion would be worthwhile. Roth conversions are elected during the tax year, you cannot perform a Roth conversion when you are preparing your taxes. Clearly in examples 2 & 3, if John and his spouse did not do any tax planning they would have missed a great opportunity to do a Roth conversion without owing any federal tax.

Disclaimer

This article is not intended as tax advice. The determination of how the tax laws affect a taxpayer is dependent on the taxpayer’s particular situation. A taxpayer may be affected by exceptions to the general rules and by other laws not discussed here. Taxpayers are strongly encouraged to seek help from a competent tax professional for advice about the proper application of the laws to their situation.